Present value of lifetime annuity

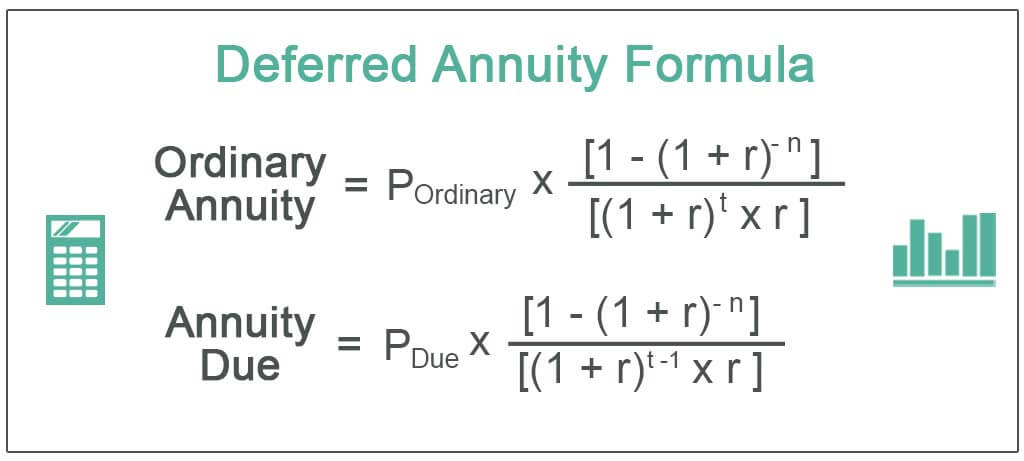

Here is the present value of an annuity formula for annuities due. The present value of an annuity is based on a concept called the time value of money.

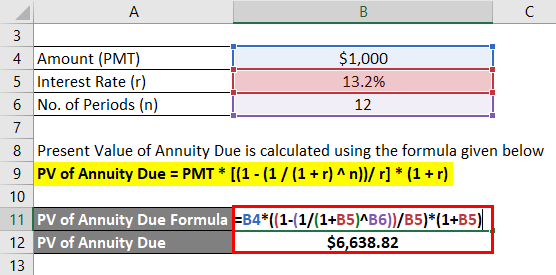

Present Value Of Annuity Due Formula Calculator With Excel Template

No Commissions or Fees.

. So the actuarial present value of the 100000 insurance is 2424485. Learn How Our Online Tools Can Help Answer Your Important Financial Questions. Now accepting rollovers transfers.

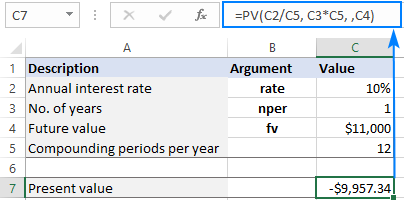

To calculate the present value of the annuity in Excel the user would select cell A4 and type fv followed by an open parenthesis. PV present value of the annuity. The present value of this.

For the uninformed this is a widely accepted theory that its better to accept a lump. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. The present value of an annuity is the current value of future payments from that annuity given a specified rate of return or discount rate.

Begin aligned text Present value 50000 times frac 1 - Big frac 1 1 006 25 Big. Using the above formula the present value of the annuity is. Want to Learn More About Annuities.

If you invest your money in an annuity plan today it is important for you to know what is the value of your invested money now and how much money. Then holding down Ctrl on the keyboard. Understanding present value of an annuity The present value of an annuity is the cash value of all future annuity payments given the annuitys rate of return or discount.

Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows r is the constant interest rate. In practice the benefit may be payable at the end of a shorter period than a year which requires an adjustment of the. Ad See How Much Income An Annuity Can Provide With TIAA Retirement Calculators.

Thepresent value random variableis Y a K1 where K in short for K x is the. Subsection 551 - Whole Life Continuous Annuity In this setting acontinuous payment of 1 is smeared over each year until time t not necessarily an integer. Review How Income Annuity Payments Work.

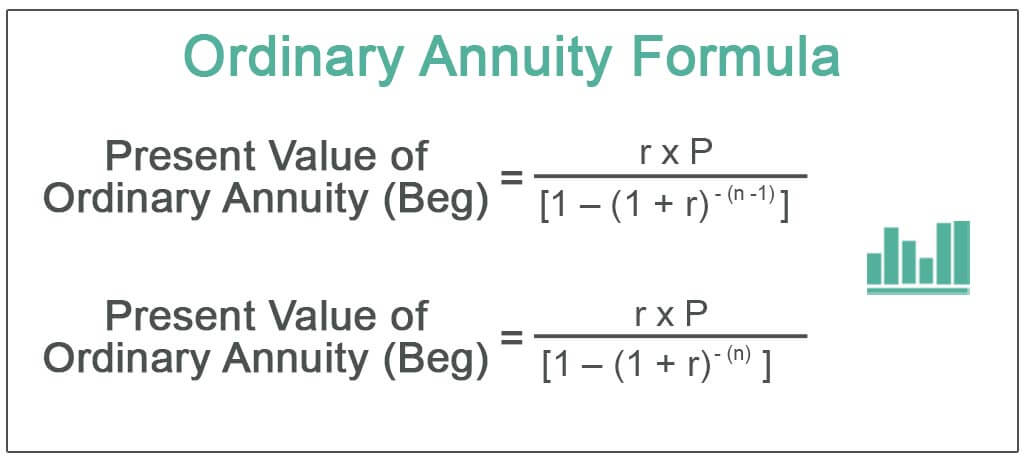

When calculating the present value of an annuity payment a specific formula is used based on the three assumptions above. Understand What an Income Annuity is How it Works. You can use the following formula to calculate the present value of an annuity.

The formula for calculating the present value of annuity is as follows- PV P 1 - 1 r -n r Here P is the Periodic Payment r is the. What Is the Present Value of Annuity. How to Calculate Present Value of Annuity.

PV PMT l gi gi where. Ad Curious About Income Annuities. Ad Simple fixed annuities with tax deferred growth and guaranteed crediting rates.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. The present value of an annuity is determined by using the. Another difference is that the present value of an annuity due is higher.

The term net in net present value means to combine the present value of all cash flows related to an investment. The present value of the annuity. Whole life annuity-due Pays a bene t of a unit 1 at the beginning of each year that the annuitant x survives.

Pin On Retirement

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

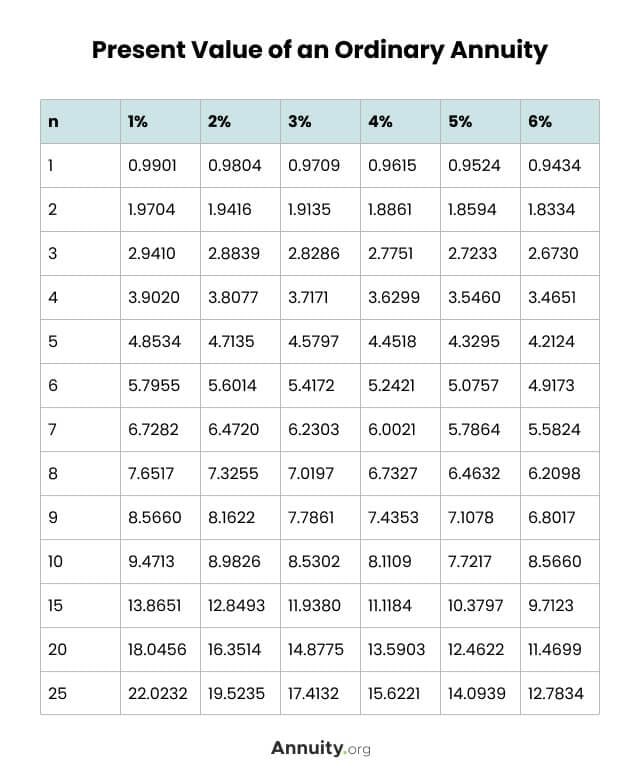

What Is An Annuity Table And How Do You Use One

Present Value Of Annuity Due Formula Calculator With Excel Template

Using Pv Function In Excel To Calculate Present Value

Ec Pazajfjqfwm

Present Value Formula Calculator Examples With Excel Template

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Present Value Formula And Pv Calculator In Excel

Present Value Of An Annuity Definition

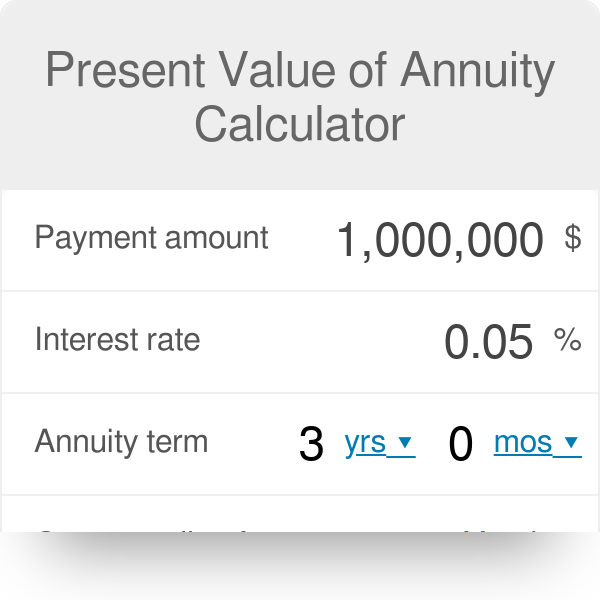

Present Value Of Annuity Calculator

What Is An Annuity Table And How Do You Use One

Present Value Of An Annuity How To Calculate Examples

Present Value Of An Annuity How To Calculate Examples

Ordinary Annuity Formula Step By Step Calculation

Annuity Calculation In 9 Minutes Annuities Explained For Present Value Of An Annuity Formula Youtube

Ordinary Annuity Formula Step By Step Calculation